Your Ultimate Guide to Renters Insurance

Comparison

|

Save upto 30%Lowest Price Insurance |

Get Your Personalized Renters Insurance Quotes Now!

Protect Your Peace of Mind with Tailored Coverage Options

What is renters insurance?

Renters insurance is a crucial safeguard for anyone who rents a home, apartment, or condo. It's designed to provide financial protection for your personal belongings and offer liability coverage in case of unforeseen events. Here at AZ Insurance Rates, we believe that understanding the fundamentals of renters insurance is the first step to making an informed decision.

Protect Your Belongings: One of the primary purposes of renters insurance is to safeguard your personal possessions. Whether it's your electronics, furniture, clothing, or other valuables, renters insurance ensures that you're covered in case of theft, damage, or disasters like fire or water damage. Even if you think you don't own much, the cost of replacing everything can add up quickly. Renters insurance offers peace of mind by helping you recover the value of your items.

Liability Coverage: Beyond protecting your belongings, renters insurance also includes liability coverage. This aspect of the policy can be a lifesaver in situations where you are held responsible for injuries to others or property damage. For instance, if a guest slips and falls in your apartment or if you accidentally cause damage to your neighbor's property, renters insurance can help cover legal expenses and potential settlement costs.

Affordable Protection: One of the best aspects of renters insurance is that it's surprisingly affordable. At AZ Insurance Rates, we work diligently to help you find the best deals and policies that suit your needs and budget. It's an investment in your peace of mind that won't break the bank.

Renters insurance is more than just a piece of paper; it's your safety net when unexpected events occur. We're here to assist you in comparing different renters insurance options, so you can make an informed choice that safeguards your home and assets. When it comes to protecting what matters most, trust AZ Insurance Rates to guide you every step of the way.

How much does renters insurance cost?

At AZ Insurance Rates, we understand that affordability is a top priority when it comes to insurance. The cost of renters insurance can vary depending on factors like your location, the coverage amount you choose, and your personal circumstances. On average, renters insurance is surprisingly budget-friendly, with most policies ranging from $15 to $30 per month.

Sometimes it can go higher depending on what you’re renting and you needs, such as $200 - but more often, it’s on the lower end. That's a small price to pay for the peace of mind that comes with knowing your belongings and liability are protected. Our goal is to help you find the best renters insurance rates that fit your budget, so you can enjoy worry-free living without breaking the bank. Get started with our comparison tool today to discover the perfect policy for you.

Renters insurance rates from Popular companies

Insurance Provider

Average Yearly Renters

Insurance Premium

Monthly Rate

Allstate

$372

$31

American Family

$289

$24

Farmers

$246

$20

Liberty Mutual

$285

$24

MetLife

$283

$24

Nationwide

$253

$21

Progressive

$305

$25

State Farm

$179

$15

Travelers

$217

$18

USAA

$186

$15

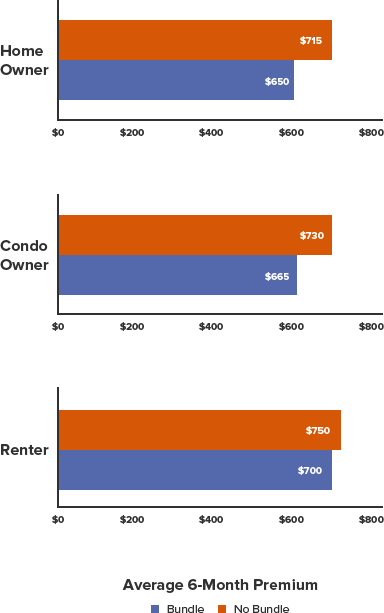

When you choose AZ Insurance Rates, you're not just gaining access to competitive renters insurance rates; you're also opening the door to valuable benefits through bundling. By bundling your renters insurance with other policies like home or auto insurance, you can enjoy significant savings and added convenience.

Save Big: Bundling your insurance policies can lead to substantial cost savings. It's a smart financial move that puts more money back in your pocket without compromising on coverage. Imagine having extra cash to spend on the things you love while still enjoying comprehensive protection.

Simplified Management: Managing multiple insurance policies can be a hassle. With bundling, you simplify your insurance portfolio. One bill, one renewal date, and one point of contact make your life easier, giving you more time to focus on what matters most.

Enhanced Coverage: Bundling doesn't just save you money; it can also enhance your overall coverage. By combining policies, you can often access broader protection and additional perks that individual policies may not offer.

AZ Insurance Rates is your trusted partner in finding the perfect bundle that fits your needs and budget. Let us help you maximize your savings and streamline your insurance experience. Start comparing renters insurance rates and discover the advantages of bundling today.

Average Premium by Bundling

Discover The Perfect Rental Insurance

Find peace of mind in your new rental unit. We find the right agent, coverage, and company that can help protect you from any problems!

Renters, Rejoice!

Unlock Savings

Up to 30% with

AZ Insurance

Rates Comparison

What does Renters Insurance Cover?

While you're renting a home or apartment, a renters policy only covers your personal belongings. No need to worry about insuring the structure, walls, or fixed furniture.

In a typical HO-4 policy, renters insurance provides coverage in four key areas:

• Your Liability: Protection in case you're legally responsible for

injuries to others or property damage.

• Your Personal Property: Coverage for your belongings,

safeguarding against theft, damage, or loss.

• Your Additional Living Expenses: Support for temporary

accommodations and expenses if you're unable to stay in your

rented space due to a covered event.

• Medical Payments to Others: Assistance with medical bills if

someone is injured in your rental space.

For instance, if a fire were to break out in your apartment, resulting in the destruction of your living room contents, rest assured that your renters insurance would compensate you, up to your coverage limits.

What is liability coverage?

Liability coverage is a fundamental component of renters insurances. It provides essential protection for you in situations where you might be held legally responsible for injuries to others or damage to their property while inside your rented space.

Imagine a scenario where a guest slips and falls in your apartment, sustaining injuries, or perhaps you accidentally cause damage to your neighbor's property. In such cases, liability coverage steps in to help cover legal expenses, medical bills, and even potential settlement costs. It's your safety net against unexpected accidents that could otherwise lead to significant financial burdens.

The typical pricing for liability coverage in renters insurance is surprisingly affordable, often included as part of the overall policy. Coverage limits can vary, but it's common to see liability coverage ranging from $100,000 to $500,000. The cost of this crucial protection is a small fraction of your overall renters insurance premium, making it a wise investment to safeguard your financial well-being. At AZ Insurance Rates, we make it easy to compare different liability coverage options, ensuring you find the right balance between protection and affordability for your unique needs.

What is personal property coverage?

Personal property coverage, a core component of renters insurance, is designed to protect your belongings inside your rented home or apartment. It's your financial safeguard against unexpected events such as theft, fire, or damage that could otherwise result in significant financial loss.

Here's how it works: Imagine your personal belongings—furniture, electronics, clothing, and more. Personal property coverage ensures that if these items are damaged or stolen, you'll receive compensation up to your policy's coverage limits. It's not just about the replacement cost of your possessions; it's about preserving your peace of mind.

The typical pricing for personal property coverage varies based on factors like the value of your belongings and the coverage limits you choose. Renters insurance policies often offer coverage ranging from $20,000 to $100,000 or more. The cost is surprisingly affordable, with monthly premiums that typically range from $10 to $30, depending on your location and the extent of coverage you select. At AZ Insurance Rates, we're committed to helping you find the best personal property coverage that aligns with your needs and budget, ensuring your cherished possessions are protected.

Renters insurance FAQs

Compare insurance rates across the United States. Whether you want life, auto, home, and more. We’ve got you covered.

Discover the best way to save!

What kind of insurance do you want to compare?

AZ Insurance Rates Copyright 2023

Powered and Built by AZ Insurance Rates in 2023. All Rights Reserved.